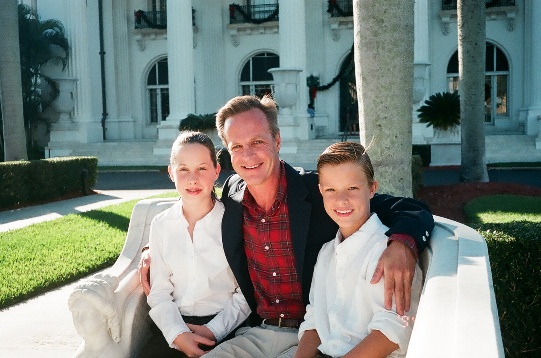

If

you read my last blog post or recent social media posts on Facebook, LinkedIn, or

Twitter, you will likely remember that my son recently suffered a major

displaced fracture of his left clavicle (collarbone) as a result of a nasty

fall from his skateboard. Thank God it was not his head for he was not wearing

a helmet!

I

had no idea what he was attempting to do on his board as he usually used it

just for transportation around the neighborhood. Apparently this time he was

trying to do “tricks.” Had I known that, I would have not allowed it sans the helmet.

The

result was a 2-hour surgery with a titanium

plate/strap screwed into place across the bone, a 3-day stay in the hospital, side affects from medication, 3 weeks out of school, considerable depression, and 6 weeks of physical therapy, not

to mention other ancillary effects on the family as a whole.

Thus,

as my son went through this trauma I vowed I would do whatever I could to save

other kids and their parents this same ordeal. So I did some research (which I

found startling to say the least), and am pleased that I am able to share it

here today.

First,

have you ever really thought rationally about just what skateboarding involves?

It involves moving very fast at times over (and very close to) a hard

and unforgiving surface.

Now moving at high speed over a hard surface is one thing when you are enclosed in a steel vehicle likely following a patterned route with countless safety precautions in place, and with little chance of falling off or out of the vehicle and hitting the ground at that speed.

Moving relatively fast over and close to

a very hard surface in or on an unenclosed vehicle is the deadly combination, and I do not mean “deadly” as an

exaggeration to sensationalize the danger. The fact is skateboard accidents

have been the cause of death to young people many times in the past.

On

average 2006 had nearly one person killed per week while skateboarding; a total

of 42 skateboarding youth died while recreating. Of these 42 deaths, 40

occurred outside of skate parks.

These

are admittedly not very recent figures, but still very sad, nonetheless.

Also, keep in mind these are the fatalities. The severe injuries, some

involving permanent brain damage and paralysis, are much more common. You’ll

read about these startling statistics below.

I

would not ordinarily take the complete transcript of another source (even while

referencing it) to use in this blog.

However,

upon finding the information below from the American

Academy of Orthopaedic Surgeons, I felt it so important and from the best

source possible, that it deserved reprinting in its entirety with credits to

the Academy. It follows below:

Most hospitalizations involve head injury. Even injuries that heal quickly can cause pain and anxiety, cost time, and money and may lead to disabilities. This can include loss of vision, hearing and speech; inability to walk, bathe, toilet, dress or feed yourself; and changes in thinking and behavior.

Skateboarding is not recommended for young children. That's because they are still growing and do not yet have the physical skills and thinking ability a person needs to control a skateboard and ride it safely.

According to the American Academy of Pediatrics (AAP):

- Children under age 5 years old should never ride a skateboard.

- Children aged 6 to 10 years old need close supervision from an adult or trustworthy adolescent whenever they ride a skateboard.

- A higher center of gravity, less development and poor balance. These factors make children more likely to fall and hurt their heads.

- Slower reactions and less coordination than adults. Children are less able to break their falls.

- Less skill and ability than they think. Children overestimate their skills and abilities and are inexperienced in judging speed, traffic and other risks.

- If you don't use protective equipment.

- If you don't keep your skateboard in good condition.

- If you skateboard on irregular surfaces.

- If you attempt "tricks" beyond your skill level.

- Inexperienced skateboarders. Those who have been skating for less than one week suffer one-third of injuries, usually caused by falls.

- Skateboarders who do not wear protective equipment. Every skateboarder should wear standard safety gear. This includes a helmet, wrist guards, elbow and knee pads and appropriate shoes. Skateboarders who perform tricks should use heavy duty gear.

- Skateboarders who go near traffic or use homemade skateboard ramps. Both activities are particularly dangerous.

- Experienced skateboarders who encounter unexpected surfaces or try risky stunts. Irregular riding surfaces, rocks or other debris can cause you to fall. You can stumble over twigs or fall down slopes. Wet pavements and rough or uneven surfaces can cause a wipeout. Avoid risky behavior. Don't skateboard too fast or in dangerous or crowded locations.

Skateboarding injuries often involve the wrist, ankle or face. Many injuries happen when you lose your balance, fall off the skateboard and land on an outstretched arm.

- Injuries to the arms, legs, neck and trunk range from bruises and abrasions to sprains and strains, fractures and dislocations. Wrist fractures are quite common. Wearing wrist guards can reduce their frequency and severity.

- Facial injuries include breaking your nose and jawbone

- Severe injuries include concussion, closed head injury and blunt head trauma.

- You can suffer permanent impairment or even death if you fall off the skateboard and strike your head without a helmet. Most brain injuries happen when your head hits pavement. You are most at risk if you skateboard near traffic and collide with motor vehicles, bikes, pedestrians or other obstacles.

So; there above is some

credible wisdom for skateboard enthusiasts and especially parents of kids who

already ride or want to take up this dangerous activity, from an

unchallengeable source; the American

Academy of Orthopaedic Surgeons. This is not just “food for thought” and

something to think about, but a cause célèbre to really take to heart and act

upon. I am.